One Family’s Journey Toward Buying a Campervan

This is part of a series that chronicles the path on researching, selecting, and buying a campervan. In this article, we lay out the dirty details of the process. This is based one family’s actual first-hand experience of getting their first campervan.

We also share the major fixes and repairs that we tackled right out of the gate. Learn more about the options available in a campervan, the pros and cons, potential pitfalls, costs, and the hoops you may have to jump through to purchase one.

We hope this post is informative and useful for all of our readers. Learn something valuable as you consider your own purchase of a campervan!

The Process is Personal

As you might expect, every experience is different based on personal interests, expectations, needs, and financial position. So while this post comes with a clear caveat that the experience of buying a campervan will be very different for different people, much of what we went through may be relevant to our readers.

Tailor the Purchase to Fit Your Own Situation

You need to consider your own personal situation. Understand your finances, credit, time frame, and your tolerance for risk. Do some research and learn more about the local market conditions. And be prepared for the unexpected.

As you’ll see, our campervan purchase process was fairly smooth. That’s due in large part because it was also very quick. From the time we started looking for a campervan until the day we drove one home was only about ten days.

Yes, I said 10 days.

Is Something Seriously Wrong with Us?

Some people take 10 weeks or 10 months (or much longer) in the research and planning phases. Large purchases require big decisions.

For whatever reason, that is not how we are wired. When it comes to life-altering purchases, we seem to leap frog the planning phases and skip right to the purchase.

When we see the right option, we know it. Then we move fast…mostly without fear (Julie drags me along when I do occasionally become mired in decision-making limbo):

- The first house we ever bought back in 2005? First house we walked through. Done.

- Deciding to move into full-time RVing took 100 days. We had NO RV experience so some may say that decision was Stupid Fast.

- Our first RV purchase in 2017? Two visits to the RV dealership to choose the right travel trailer. Done. Ok, ok, we also spent a couple of weeks researching online prior to the first in person visit.

- The rental house we are living in now? First house we walked through. Done.

I could probably give you a dozen other examples, but you get the idea.

Have we ended up regretting any of those rapid decisions? Nope. Not yet.

Why Does a Quick Decision Approach Work for Us?

I think we have developed a trust over the years with our gut reaction to large purchases. We’ve developed a tolerance for operating with unknowns still in the mix. We’ve learned to accept the reality that other options are indeed out there that we have definitely not even considered.

What makes this possible? For one thing, years of practice. We are also very adaptable people who can make things work without much fuss.

Imporvantly, we made this decision quickly, not in pursuit of perfection, but in pursuit of adventure. That was our top priority.

All of that is to say: We may be a bit abnormal.

Take that into consideration as you read the rest of this post about buying a campervan. Remember please that we don’t encourage rash decisions. We don’t recommend anyone do things the way we do things.

Rather, we want to share our experience. We do hope you (a) enjoy the story, and (b) find some helpful information.

Our Process for Buying a Campervan

If you have spent any time at all looking at the RV market, you know it’s nuts! Completely and utterly nuts.

So let me just say upfront if you are just taking your first steps: Brace yourself.

One particular conversation I had with an RV salesperson in Texas put everything into perspective for me. I had contacted him about one particular new campervan (2021 Entegra Ethos 20T) we had been eyeing online.

The dealership was located in an area about two hours drive away. So I wanted to first make sure the campervan was still on the lot and available for us to tour.

Yeah, not so much.

The State of the RV Market

Guess what. Not only was that campervan not available, there was not a single Class B or campervan on the lot. Not one. You’re probably thinking it was some rinky-dink little dealership with low inventory.

But you would be wrong.

RV INVENTORY IS AT LOW CAPACITY

In fact, this Dallas area RV dealership claims to be “the #1 Volume Selling Motor Home Dealer in the World”. Yes, the WORLD!

And yet, they didn’t have a single Class B or campervan on their lot. Simply incredible.

The sales rep said the dealership typically has 1,200 different motor coaches on the lot at any given time. And that’s based on his 30 years of experience.

The day I spoke with him? They had a total of 50 motorcoaches (Class A, B, C, C+) available to view.

Now remember this is a big business with world leading sales. So of course they had inventory orders outstanding. In fact, they had 2,000 motor coaches on order from different manufacturers. Unfortunately, they also had no idea of when those RVs would be delivered.

On top of that, they already had 450 non-refundable deposits of $5,000 from customers wanting to purchase a motorcoach. Meaning many of the RVs arriving in the next year were already sold!

If we had waited and bought a new rig from the dealer, we would’ve had more big decisions to make. A non-refundable downpayment is required. A big downpayment. At that time, $5,000 was required as a deposit for a new Class B/campervan. I’ll just reiterate that deposit is non-refundable.

The $5,000 deposit amount is based on a sticker price of around $100,000.

We weren’t willing to wait. Even submitting a deposit would not eliminate being at the mercy of the market. We would have been left hoping and guessing about the delivery time.

The only available strategy would be cross your fingers to MAYBE get into an RV by the following Spring. That was the best case scenario for us in the new RV market.

WILL THE RV INDUSTRY RETURN TO NORMAL

We learned more from our sales rep. He added one other prediction to put things into perspective:

There were no expectations that the inventory for new RVs would return to levels seen in years past.

We realized what we learned about the RV industry was not a short um, speed bump. This is now the norm for new drivable motor coaches. While it may not be pretty, take solace knowing that at least now you know.

Time for a Pivot into the Used RV Market

Not surprisingly, this convinced us that a new Class B or campervan was not in the cards for us. We were simply not willing to wait that long without any guarantees on the timeframe at all.

No problem! We had already been poking into used Class Bs on the private party side of the equation as well. A couple of good resources are Craigslist and Facebook Marketplace.

A couple of options nearby really got our interest. One in particular had an almost identical layout to the new unit we hoped to view at the dealership.

FIRST THING’S FIRST, TAKE A TOUR

Time to take our first tour! I contacted the seller of a 2018 Carado/Hymer Sunlight Van One with 40,000 miles. Then we met at a local shopping center about 3 miles from our house on a Friday evening. Easy.

The seller (and original owner) gave us a rundown of the campervan features. We discussed the van’s history and had a straightforward, honest overview of areas that needed attention.

The primary problem was an interior cosmetic issue that we knew we could manage.

Overall, we liked everything about the van, a fact we we worked hard to disguise as we toured. And we felt confident that we were dealing with an honest, trustworthy seller.

PUTTING DOWN A DEPOSIT ON A CAMPERVAN

We told the seller we were interested and agreed to put down a $1,000 non-refundable deposit. The seller offered us nearly three weeks to arrange financing and close the deal.

These were far better terms than I was expecting. We felt good about this opportunity because the van really felt like a perfect fit for us. It also helped boost our confidence that we felt good about the seller’s intentions.

After tossing it around a bit more on Friday night, we decided to pull the trigger. Despite a total lack of certainty about our financing options, I handed the seller $1,000 in cash the next morning.

Overall, we felt there was less risk compared to other options in a highly competitive RV market. So it was time get moving on the financing. It’s important to understand the interest rate, loan duration, and monthly payment (including insurance, gas, storage, etc.).

RV Financing Has Tight Conditions

Because we had previously purchased an RV (our first and only), I thought I knew what to expect next. Based on the $68,000 purchase price for this campervan, I expected:

- A 15-20% ($10,000-$13,000) down payment

- Finance for 15-20 years

- Monthly payment under $600

If this was simply a purchase for leisure experiences, I would NOT have moved forward based on those estimates.

But as you may have noticed, our small businesses revolve around the RV industry. It’s our lifestyle that we eat, sleep and breathe. The work we do in this industry puts food on the table.

Of course, we would enjoy more outdoor experiences and get personal satisfaction as a result of purchasing this campervan. But, that only “moved the needle” in our overall decision. Owning a campervan enabled us to continue developing Trekkn and providing information about maintaining an outdoor lifestyle.

Buying a campervan was a calculated business decision. We truly believed it would move our businesses forward in the months and years to come. Case closed. Of course, I had to remind myself of this whenever I choked on the numbers.

RV LOAN CAPPED AT $35K

As an Air Force veteran with another vehicle financed through USAA, that was a logical place to start. And what a start…

It was a shock to find out that USAA would only loan a maximum of $35,000 on ANY RV. That was the max, regardless of the age or condition of the vehicle. Even an excellent credit score would not increase the limit. No exceptions.

I’m not sure when they implemented that policy. It did, however, strike me as being out of step with the current market conditions. I understand the bank’s interest is to minimize risk. However, that strict policy may be resulting in a lot of missed revenue.

Regardless, I was neither willing nor able to increase our downpayment to $33,000 for this campervan. USAA was not an option for financing. Next.

RV LOAN FINANCING TERMS ARE LESS FLEXIBLE

Randolph-Brooks Federal Credit Union (RBFCU) is another military-affiliated banking institution. I first used them in 1998 when I joined the Air Force. Conveniently, there was a branch located nearby. So RBFCU was the logical next choice.

I checked their website to get some initial information about the loan process. It was a pleasant surprise. They published interest rate ranges for RV loans as well as monthly payments per $1,000 financed. Loans were avaialble for loans up to 180 months (15 years). Perfect!

At a purchase price of $68,000, I felt confident that we could secure a 10-15 year financing term with RBFCU. We jumped right in and applied online, requesting a 180 month loan. What a rush!!

Within hours, we had a response from the credit union. Another great surprise. Unfortunately, the response was not exactly what we were hoping for.

It wasn’t all bad news. We were approved for the loan amount we requested. And, thankfully, we also received the lowest rate available (3.5%). Yay!

The bit of bad news was that they did not accept our request for a 180 month term. The bank countered offered financing for 84 months. That means the loan would need to be paid off in seven years. Said differently, it changes the amount of the monthly payment.

The term is an important variable to consider. Of course this is obvious right? Just see the table above.

For every $1,000 borrowed, we would pay about $12 per month at a 3.5% rate for a 96 month term. That payment increases to $17 per month for a 66 month term. In this example, if we borrowed $68,000, the difference is $340 each month!

DISCUSS RV FINANCING OPTIONS WITH BANK

Well, I wasn’t sure what to do with this information. The new numbers scared me. Part of me wanted to simply walk away. Maybe it wasn’t the right time for us to make such a huge purchase.

We got on the phone with RBFCU and discussed the details of their financing offer. Long story short, at that financing amount of around $68,000, 84 months was the highest term they could offer.

I was honestly floored. Surely digging into the issue a bit more would open up other options. Boy was I wrong.

Time for some deep breathing.

On the bright side, we learned we would need only about $2,000 to close the deal. That was for the financing only. It excluded tax, title, and licensing fees. This was MUCH less than we originally anticipated. Recall, I was expecting to need about $10,000-$13,000 for a down payment.

Making a Final Decision to Finance Campervan

All in all, this is how it stacked up with the RBFCU loan option:

- 84 month financing (much shorter than expected)

- 3.5% interest rate (much better than expected)

- About $2,000 down payment required, plus state sales tax (around $4,250) when we transferred title (about half of what we expected out of pocket)

- A monthly payment of approximately $900 (gasp…that’s a whopper!)

- Ability to close the loan in 1-2 days (no risk of missing out on this van)

Good and bad, pros and cons, like anything else in life, right?

We had to decide if it truly made sense for our current business situation. We needed to set aside the inevitable emotions for a few minutes.

REVIEW OPTIONS WITH AN OBJECTIVE LENS

When we stopped to look at it objectively, we realized we needed to reframe our perspective and shift the plan:

- A shorter financing term will help to keep us out of a negative equity position.

- Lower interest rates help offset the monthly payment with that shorter financing term.

- A lower down payment meant we could set aside some business profit ($6,000-$8,000) in a separate account. We would use that to make higher monthly payments and reduce the potential stress.

- In this tight market, getting into a campervan quickly was unexpected. This purchase would allow us to get back to our personal and work lives. We needed to restart our daily routines and refocus energy on our businesses. Getting back to work would mitigate the additional expense.

- Last but not least, the campervan opened up opportunities for outdoor adventures. That renewed our passion for RVing. We had been living a stationary lifestyle for about 2.5 years without an RV so, this was an exciting point.

Despite a much higher-than-expected monthly payment, we chose the RBFCU financing and aimed to seal the deal quickly.

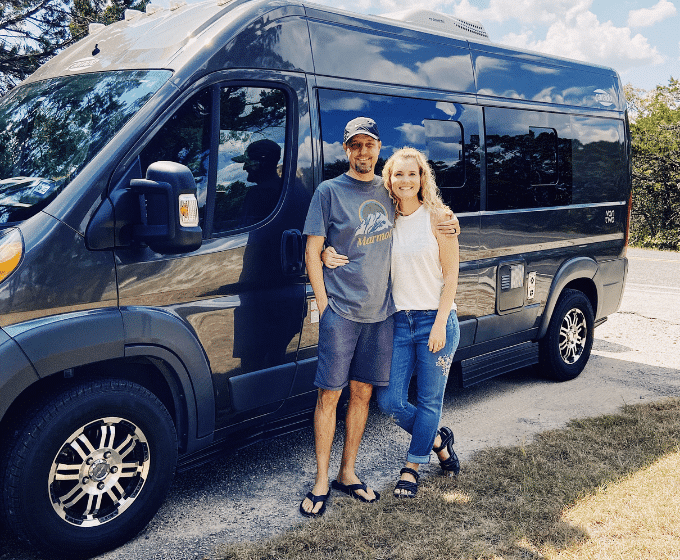

Bringing the Campervan Home!

As quick recap: We started “getting serious” about the campervan search the week of September 6th, looked at this campervan the evening of September 10th, put a $1,000 deposit down on September 11th, applied for financing with RBFCU on September 13th, completed Q&A with the credit union on September 14th, received the financing and closed the deal on September 16th.

Once we picked up the checks at the credit union, we headed right over to the seller’s house to get all of the paperwork taken care of and finalize the sale. I drove away in this perfect (for us) campervan with my head spinning at the speed of this whole ordeal.

I mean, wow! Could this really be happening?

SHE FITS IN THE DRIVEWAY … SO NICE

One nice little added bonus of having such a compact RV? She can easily fit into our driveway and live there instead of having to be stored at an RV storage lot.

This saved us $100/month or so and a lot of hassle and headache of having to go back and forth to the lot to work on her, prep her or bring her back to our house before an excursion.

In these first few weeks that she has been home with us, she has seen a lot of me. I mean, a lot.

Be prepared to officially became a “tinkerer”. There are a lot of things that can be diagnosed, adjusted, repaired and cleaned.

With our beautiful new to us campervan sitting in the driveway, it was easy to access. Why wouldn’t I get to know every nook and cranny and nuance? I wanted to take the best possible care of her to ensure we would have the best possible adventures!

Don’t Forget RV Insurance

Speaking of taking care of our new campervan, we highly recommend researching insurers. Understand all your options before choosing an insurer for your campervan or RV.

There couldn’t be anything more stressful than getting in a major RV accident and then finding out that your insurance carrier is NOT going to take care of you or your RV! Don’t let this happen to you. The newest “kid on the insurance block” that you’ll want to check out is Roamly. It’s an insurance company built by RVers for RVers.

We found Roamly to be a great resource. It may be able to help alleviate many of the headaches you could potentially face with an RV insurance claim.

THE LEARNING CURVE HAS BEEN….WET

One thing that stood out when maintaining the travel trailer we bought in 2017 was this: Water is the enemy!

In the trailer, we experienced several water related crises. Thinkin leaking roof, frozen and cracked water pumps, etc… I realized quickly that mitigating water issues is a huge part of RV maintenance and repair.

Well, things started off in much the same way with the campervan: WET.

I won’t go into all the details. You know by now we love hiking trails, and campsites and beautiful rivers. However, that is no longer true when the river is inside our campervan. Seeing water flowing through the aisle was not how I hoped to start things off.

Thankfully, several towels and lots of time with the hair dryer took care of the mess. We diagnosed and repaired the issue within a couple of days.

OUR MAIDEN VOYAGE (AKA “SHAKE DOWN” TRIP)

Since then, we were able to start exploring in our campvan. We took her to out for three nights at a couple of nearby locations. The drive was about an hour or so from our home near Austin, TX.

These short excursions allowed us to really get to her know. We worked out all of the kinks….and controlled all of the water sources.

Everything went very smoothly on our maiden voyage. We feel now, more than ever, that this campervan is the perfect “couple’s getaway capsule” that we were hoping for.

At only 19.5 feet long, she can safely and conveniently take us anywhere and everywhere we want to go. In the months and years to come, we will be adventuring together across the continent.

In the coming weeks, we will continue to share the details about “Kona the Campervan”, including lessons learned. For now, we’ll share how we came up with the name. We lived in Kona, Hawaii for 8 months. While we were there we rented a campervan very similar to this one. We absolutely fell in love with that van. So I guess the name is based on love and good memories.

We are so excited to share all of it with you! Stick around as we put together upcoming travel plans in the next couple of months. Maybe we will be able to cross paths with you in our travels.

Until then, keep on TREKKN!

Todd loves a competitive game of table tennis, a breathtaking hike, and exploring new places. He lived and traveled in an RV with his family as they traveled throughout much of the US and parts of Canada. Todd has extensive knowledge about RV travel, safety, and accessories and has shared many of his stories here on TREKKN. When he’s not busy launching and building small businesses, you may find him staring at pictures of Glacier National Park (probably his favorite spot on earth).

Happy Camping!! My husband and I bought our Class B just over a year ago.. and I think we got the last one before the huge shortage hit. Actually, we lucked out because while we were on the waiting list (a few months out) someone else’s deal fell through and our sales guy gave us a quick call. We were at the dealer in 1/2 hour! Over the past year we’ve traveled 30,000 miles in our PleasureWay OnTour and hope to do more this year. I also love Tunisian crochet and your Bryn blanket caught my eye… Maybe we’ll see you on the road somewhere…

Congrats on that adventure capsule! Sounds like a perfect fit.

We just spent 6 weeks (6K miles) in ours and got home a couple of days ago. Overall a very good fit for us also!

Glad you are enjoying Julie’s crochet creations also…happy travels and we hope to see you out there.